Interest Rate Modelling

Multi-curve dynamic and stochastic models; Behavioural modelling and dynamic assumptions; Impact of low rates and negative rate challenges

During this 3-day online course, Participants will gain insights in how to develop interest rate modelling with essential concepts such as multi-curve dynamic and stochastic models, behavioural modelling, dynamic assumption and hedging strategies. The training course also cover the impact of low rates and negative rate challenges, and IRRBB management.

Join us to learn how to apply best practice approaches within interest rate modelling.

What will you learn?

- Understanding multi-curve dynamic and stochastic models

- Essential planning for behavioural modelling

- Practical insights in interest rate model complexities and hedging strategies

- Introduction to interest rate risk and IRRBB introduction

- Impact of low rates and negative rate challenges

- Interest Rate derivatives and swaps options

- How to respond to a potential interest rate hike

Who Should Attend?

Relevant departments may include but are not limited to:

- Interest rate risk

- Balance sheet management

- Liquidity risk

- Risk management

- Model validators

- Regulators

Sessions Include

-

Multi-curve Dynamic Models

-

Stochastic Models

- Behavioural Modelling and Dynamic Assumptions

-

Various Model Complexities and Hedging Strategies

-

Interest Rate Risk

-

IRRBB: Setting up Limits and Balance Sheet Management

-

Impact of Low Rates and Negative Rate Challenges

-

Interest Rate Derivatives

Pricing options

We offer flexible pricing options for this course:

-

Early bird rates

-

Group rate

-

Enterprise rates

-

Visit registration page for further information or contact us on risk.training@risk.net

Course Tutor

Dr Howard P. Haughton

Quantitative financial risk expert

Risk Reward

Dr Haughton is an international recognized quantitative financial risk expert, industry consultant and senior research fellow specialising in computational finance for more than 30 years.

Following completion of this PhD in Mathematical Computer Science (1989), he has held a series of senior positions in risk and capital markets within large financial institutions including those related to mathematical modelling (Lloyd’s Register), model validation ( JP Morgan Chase), which lead to global directorships at Deutsche Bank (money markets and derivatives risk), Merrill Lynch (establishing the quantitative credit risk function), and at Dresdner Bank AG (mathematical methods and software implementation, pricing derivatives and structured products).

A career shift resulted in taking on the role of Chief Risk Officer and co-Head of Treasury at a Building Society while serving as an Adjunct Professor of Finance at the University of Technology, Kingston.

He subsequently took on the role as Quantitative and Economic Advisor to the Commonwealth Secretariat, UK (2015-2018).

His most recent work in the field of sustainable development has enhanced awareness as to how sovereign contingent liabilities and financing for development can be better achieved. He has provided policy advice to sovereign states globally related to sovereign wealth funds, infrastructure development, debt and capital management and project financing.

Dr Haughton’s advisory services and research extends to that of leadership, corporate governance, diversity and inclusion. In this respect he has developed a framework for achieving inclusive leadership primarily in financial institutions.

He has published widely across a number of subject areas including the recent The Woken Leader (2020).

Dr Haughton holds advanced degrees including a PhD in Mathematical Computer Science (Wolverhampton University) an MBA in Financial Strategy from Oxford University Said Business School, and a Master’s degree in Mathematical Finance (University of York, with distinction).

His professional qualifications include Chartered Risk analyst (AAM), Chartered Wealth Manager (AAM, Chartered Asset Manager (AAM), Chartered Portfolio Manager (AAM) and Certified Treasury Professional (AFP).

For more than six years, Dr Haughton has been a visiting senior research fellow at King’s College London specialising in computational finance where he is responsible for the coordination of the core module of the MSc in Computational Finance and teaching industry leaders within financial institutions.

Risk Reward Ltd is delighted to have Dr Haughton join the C-Suite Innovation and Leadership Executive Debriefs, risk management suite and and quantitative experts team in 2011.

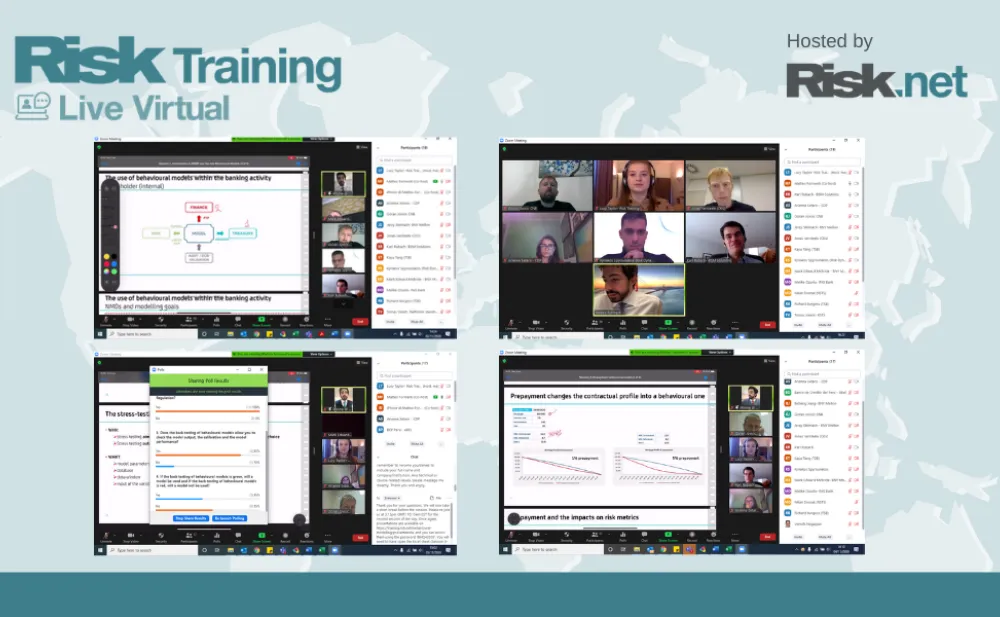

Live Virtual training courses

Our live virtual training courses have been designed to engage and inspire you. Much more than a webinar, our approach includes:

-

Technical content compressed into 60-minute interactive sessions and spread out over two, three or four days

-

Facilitated collaboration including Q&A, interactive polling and group workshops

-

Live interaction with subject matter experts – get your questions answered in real time

-

Receive comprehensive course materials and supporting content from Risk.net to reinforce your learning

-

Stay connected with other learners and extend your network by joining our dedicated LinkedIn group for course participants

The online operational risk training course was great. It gave me inspiration on how to develop my risk management department

Spar Nord

A very professional and serious virtual training course

KommuneKredit Denmark

Leading experts with comprehensive material covering important topics in a very concrete and useful manner

Banco Santander Mexico

Having complex material presented by people with both a sound theoretical base, combined with actual real life experience, is the best means for us to get useful knowledge to deal with the challenges we face in today's financial environment

Cidel Bank & Trust

It was my pleasure to share my thoughts and experience and I enjoyed the feedback and questions. Outstanding virtual event. Thank you Risk Training

Northern Trust Corporation

Not the course for you?

Risk Training offers a great selection of courses providing practical guidance on the latest trends, challenges and regulatory changes that span risk management, regulation and derivatives.

Interested in a tailored course?

Researched in conjunction with our portfolio of expert tutors, Risk Training: Bespoke Solutions can bring your company tailored, in-house courses for any number of attendees.

E-Learning

Risk Training's self-paced E-Learning platform offers Advanced Operational Risk programme. Covering in breadth and depth the most topical elements of operational risk management and its challenges for financial services